Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. If you need to borrow money from someone other than friends and family, you’ll need to have your books together. The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited. The more information (and supporting documents) you can give your CPA at tax time, the more deductions you’ll be able to legitimately claim, and the bigger your tax return will be. Keeping an accurate, up-to-date set of books is the best way to keep track of tax deductions (expenses that you can deduct from your taxable income). It ensures that you don’t miss out on tax deductions Getting your books together and producing financial statements is the only way to gauge the financial health of your small business.Īre sales up? Are your shipping costs too high? Will you have enough money next month to cover payroll? Is cash flow increasing or decreasing? The only way to know for sure is to start bookkeeping. And the only way to know that for sure is to have accurate, up-to-date books. You need to know your net profit in order to do your taxes, and to figure that out, you need to know your total income and expenses. We’ll start with our five favorite reasons.

#BENCH BOOKKEEPING EXCEL PASSWORD SOFTWARE#

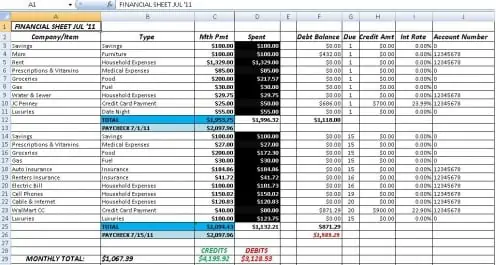

Bookkeeping is the process of tracking all of your company’s financial transactions, usually by entering them into accounting software or a physical set of “books.” It lets you see exactly where your business is spending money, where your revenue is coming from, and which tax deductions you’ll be able to claim.

^ "A Virtual Accounting Department for Small Businesses".^ "Why This Bookkeeping Company Created the Ultimate Guide for Mental Health at Work".^ "Bench raises $16 mln from Bain, Altos, Contour".^ "Bookkeeping For Those Who Don't Like Using An App".

#BENCH BOOKKEEPING EXCEL PASSWORD SERIES#

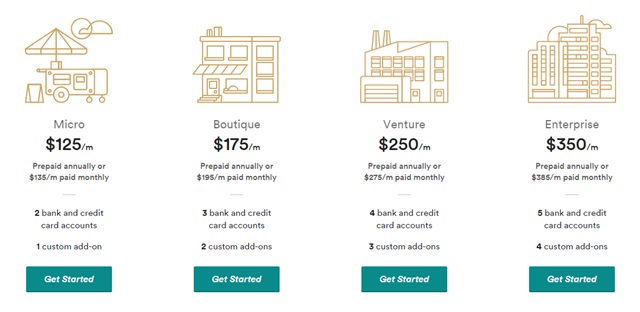

^ "Bench Bookkeeping Service Cooks Up $7 Million Series A".Īs of August 2019, Bench announced BenchTax in partnership with Taxfyle in order to provide tax preparation and filing for clients. In June 2019, Bench launched a new cash flow management tool called Pulse. Bench Bookkeeping also integrates with several other third-party apps including Stripe, Square, and PayPal. Services include historical and monthly bookkeeping, cash flow and expense tracking, and financial reporting. Bench’s core product is online bookkeeping software paired with in-house bookkeepers. Product Features and Integrations īench is available on desktop and iOS mobile app. In 2018, Bench secured $18 million in a B-1 funding round led by iNovia Capital with participation from existing investors Bain Capital Ventures, Altos Ventures, and Silicon Valley Bank. In 2016, they raised $16 million in Series B funding, led by Bain Capital Investments, with Altos Ventures, and Contour Venture Partners participating. In January 2014, Bench Accounting raised $1 Million from VCs and angel investors. History Ģ012: Accepted by TechStars NYC’s accelerator program as 10sheet Inc.Ģ013: Raised $2M in seed capital and launched to the publicĢ013: Moved to Vancouver, BC and changed our name to BenchĢ018: Raised an additional $18M in Series B-1 fundingīench launched their product to the general public in 2013 after raising a $2 million seed round, followed by $7 million in Series A funding led by Altos Ventures, with Contour Venture Partners participating. Bench has raised $53M in funding to date and currently employs around 650 people out of its Vancouver headquarters. The company provides subscription access to cloud-based software in combination with in-house bookkeepers. Bench Accounting (branded as "Bench") is a fintech company that uses proprietary software to automate bookkeeping and provide financials for small business owners.

0 kommentar(er)

0 kommentar(er)